Life Insurance Simplified

Life insurance in Peoria, IL, is about more than a policy; it’s a plan to protect your family’s future.

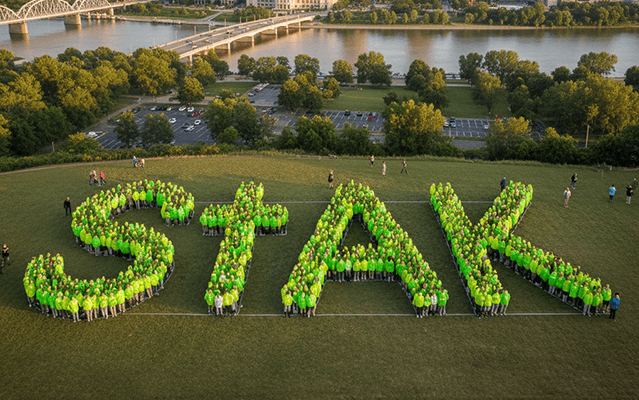

At StAK Insurance Solutions, we help Central Illinois families compare affordable term, whole, and final expense options from multiple carriers, with guidance you can trust, not sales pressure.

Unlike online calculators or national hotlines, we take the time to understand your story before recommending a solution. We ask questions about your family, debts, goals, and lifestyle, and we explain your options in plain English. Our job isn’t just to sell you a policy, it’s to give you peace of mind that your plan will work exactly as you expect when your loved ones need it most.

Income Protection Replaces lost wages so your family can maintain their lifestyle. PROTECT YOUR BUDGET

Debt Coverage Pays off mortgages, car loans, or other debts so loved ones aren’t left with the burden. PROTECT YOUR FAMILY

Education Funding Helps children or grandchildren pursue college or vocational training. PROTECT YOURSELF

Finding the right life insurance in Peoria IL for your needs

Term Life Insurance

Term life provides coverage for a set period — usually 10, 20, or 30 years — and is often the most affordable way to get a large amount of protection. It’s perfect if you’re in your working years and need to:

- Replace income while kids are in school

- Cover a mortgage or home equity loan

- Provide financial stability until retirement savings mature

When the term ends, you can either renew coverage, convert to permanent coverage (in many cases), or let the policy expire if you no longer need it.

Whole Life & Permanent Coverage

Permanent life insurance lasts for as long as you live and may build cash value over time. This makes it an attractive option if you want lifelong protection or the ability to borrow against your policy in the future.

- Whole Life: Level premiums and guaranteed coverage for life.

- Universal Life: Flexible premiums with potential cash value growth.

- Indexed Universal Life: Offers market-linked growth potential with downside protection.

Permanent coverage can be a valuable tool for estate planning, tax-advantaged wealth transfer, and even supplementing retirement income.

Final Expense Insurance

Final expense coverage is a simple, affordable way to handle funeral costs and small debts. It’s easy to qualify for and helps protect your family from unexpected expenses.

For trusted state information about life insurance in Peoria IL, visit the Illinois Department of Insurance.

StAK Insurance Solutions can help you compare plans and find coverage that fits your needs and budget.

Living Benefits

Modern life insurance isn’t just about death benefits. Living benefits allow you to access part of your policy’s value if you’re diagnosed with a qualifying critical, chronic, or terminal illness. This can be a financial lifeline that:

- Pays medical bills not covered by health insurance

- Covers mortgage or utility payments if you can’t work

- Gives you choices about where and how to receive care

How we work

Our process is designed to make life insurance in Peoria clear and stress-free:

-

1

Discovery Call:We learn about your family, finances, and long-term goals.

-

2

Options & Comparisons:We shop multiple carriers and present options side by side with pros, cons, and pricing.

-

3

Decision Support:We guide you through choosing coverage that balances price and protection.

-

4

Ongoing Reviews:We check in over time as your needs change — marriage, kids, new home, to keep your plan updated.

Our clients often tell us they feel relieved after meeting with us, because for the first time, they actually understand how life insurance in Peoria works and what they’re paying for.

Why Work With StAK Insurance Solutions

- Independent & Local: We compare plans from multiple carriers, not just one.

- Plain-English Explanations: We translate jargon into language you can understand.

- Family-Owned Agency: You’ll work with Mike and Natalie directly, not a call center.

- Veteran & Educator Leadership: Discipline, service, and a passion for teaching are at the heart of what we do.

- Year-Round Support: We’re here to adjust your coverage as your life evolves.

Protect your family’s future today.

We’ll start with a short discovery call, prepare a no-cost proposal, and help you put a plan in place with no pressure or obligation to commit.

Even if you’re just starting to think about life insurance in Peoria, talking with a local, independent agent can help you avoid overpaying or being underinsured.

Call Now: (309) 453-6546

Life insurance FAQ's

Term life is temporary coverage for 10–30 years. Whole life is permanent coverage that lasts your lifetime and may build cash value. If you want affordable protection during your working years, term is often best. If you want guaranteed coverage or to build cash value, whole life is worth considering.

Many experts recommend 7–10 times your annual income, but the right amount depends on debts, children’s ages, and future goals. We run a full needs analysis during your consultation to recommend the right level of protection.

Even if you have diabetes, high blood pressure, or other conditions, many carriers offer coverage. We compare underwriting guidelines across multiple companies to find your best fit and most competitive rates.

Your policy may lapse after a grace period. Some permanent policies allow you to use accumulated cash value to keep the policy active, or to convert it to a smaller paid-up policy so you don’t lose coverage entirely.